The Delivery Delays Report: Where shoppers are at risk of late deliveries

New data from Esendex reveals a growing gap in the availability of delivery workers across Ireland, threatening to cause delays for shoppers this festive season.

Delivery delays report 2025

The final three months of the year are one of the busiest shopping seasons worldwide, known to retailers as the Golden Quarter. Spanning Black Friday and Cyber Monday through to the busy holiday season, consumer spending typically increases, creating a bumper season for businesses.

But this year, logistics challenges may leave shoppers disappointed, as new data from Esendex reveals a growing gap in the availability of delivery workers across Ireland in 2025, threatening to cause delays in meeting seasonal delivery demands.

This year’s analysis builds on Esendex’s 2024 Delivery Delays Report, refreshing the data to track how vacancy levels have shifted over the past 12 months. The updated 2025 figures reveal that shortages have not eased, and in several regions, the delivery gap has widened.

A growing delivery crisis behind the Golden Quarter

Irish consumers are spending more online than ever, with Golden Quarter spending rising 2.9% year-on-year and ecommerce revenue expected to reach €6.23 billion in 2025. Esendex data also found that 77% of consumers rein in their spending up to a month before Black Friday, so they can splurge on sales and discounted items.

While shoppers are on the hunt for quality deals and last-minute purchases, retailers are heavily reliant on HGV and delivery drivers throughout this period, to ensure they can match the sharp rise in demand and keep customers happy.

Nationally, ecommerce activity has experienced significant growth, with 85% of all internet users purchasing goods and/or services online in 2024, up from 78% in 2023.

Research shows that 83% of Irish consumers were planning to use the Black Friday sales weekend to buy Christmas gifts, while almost two-thirds (63%) favour online shopping with either home delivery (48%) or click and collect (16%). This indicates retailers are more dependent than ever on reliable courier and HGV services to keep pace with demand.

However, the sudden collapse of Fastway Couriers ,one of Ireland’s largest parcel operators, created a severe bottleneck just before Black Friday. Retailers now face rising delivery costs, forced rerouting to limited courier alternatives, and widespread delivery delays.

An estimated 70,000 parcels are also believed to have been left in limbo, weeks before the highest-volume period for ecommerce deliveries.

Even before the collapse, Irish delivery networks were under strain. An Post had already warned of a 25% year-on-year increase in parcel volumes from existing customers alone, and the collapse of Fastway Couriers has now led them to hire an additional 1,000 seasonal staff across the country to assist.

With customers expecting correct deliveries, clear communication, and swift turnarounds, more so during these months than any other time in the year, it places immense strain on businesses to manage high order volumes and keep on track with delivery targets.

And a growing shortage of delivery drivers can lead to potential bottlenecks in some regions, posing a risk of severe delivery delays that could directly impact customer satisfaction.

To avoid this, businesses must operate a system of transparency and accountability. While delays will be unavoidable to some extent, managing customer expectations with clear and consistent updates using SMS solutions can ensure businesses maintain high customer satisfaction – especially as delivery information remains one of the most valued messages that customers wish to receive.

Retailers should also be looking to connect with customers where they are, using WhatsApp for Business to provide a channel that facilitates two-way communication and drives effective communication and higher engagement.

The regions most at risk of delivery delays in Ireland

To identify which regions are expected to be the most at risk of delivery driver shortages, our team analysed over 96,512 job listings across the United Kingdom (UK), Ireland, and Australia, to pinpoint the regions and cities most at risk of delays this Black Friday and Christmas period.

We used Indeed data and looked at the number of job vacancies in each region for the most common delivery job titles, including ‘heavy goods vehicle driver’, ‘delivery driver’, ‘logistics coordinator’, ‘picker packer’, and ‘parcel sorter’. We also analysed the current listings for ‘Christmas’ driver’.

The ‘Delivery Delays Report’ highlights a potential challenge for Irish retailers in meeting delivery demands throughout this peak shopping season.

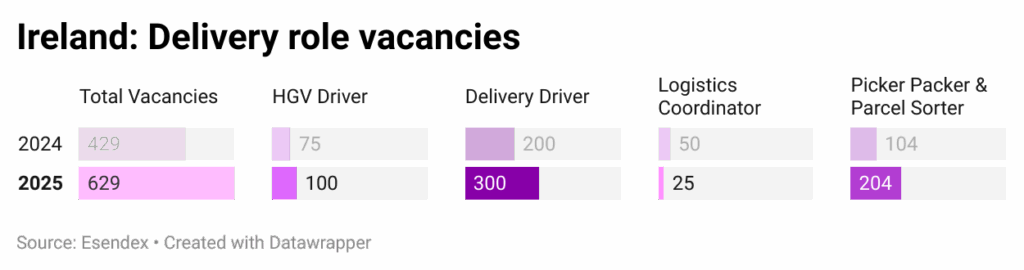

Nationally, Ireland has 629 unfilled delivery-related job roles, up from 429 in 2024 – a 47% year-on-year increase. This equates to 11.8 vacancies per 100,000 residents, signalling that labour gaps within the delivery workforce have widened considerably over the past 12 months.

Some counties are already showing signs of potential strain. County Carlow had the largest vacancy gap of 2.9 per 10,000 residents, a staggering 157% year-on-year rise.

Close behind, County Galway recorded 52 total vacancies, and despite its higher population, still has a sizable vacancy rate of 2.7 per 10,000 residents – up nearly 230% since last year.

Delivery job shortages across regions in Ireland (per 10,000)

| County | Delivery Vacancies (Total) | Delivery Job Gap (per 10,000) | Delivery Gap % change since 2024 |

| County Carlow | 18 | 2.9 | 157.1% |

| County Galway | 52 | 2.7 | 229.7% |

| County Cavan | 18 | 2.2 | -10.0% |

| County Sligo | 15 | 2.1 | 87.5% |

| County Mayo | 20 | 1.5 | 67.6% |

| County Donegal | 20 | 1.2 | 53.8% |

| County Clare | 12 | 0.9 | -40.0% |

| County Kerry | 13 | 0.8 | 160.0% |

Delivery shortages across cities and towns

Drogheda emerged as the area most at risk of delivery delays, recording a substantial 12.7 vacancies per 10,000 residents. As a major industrial and port hub, this represents a significant shortfall that could leave local carriers struggling to cope with peak-season demand.

Drogheda also overtook Dublin as the location with the highest delivery vacancy gap in 2025, rising a staggering 460% since 2024.

Cork and Dundalk follow with vacancy gaps of 5.1 and 4.6 per 10,000 people, respectively.

Meanwhile, Dublin has the highest number of total vacancies nationally (350), but its larger population base of over a million people reduces its per-capita vacancy rate to 3.4 per 10,000 residents, suggesting it may be comparatively more resilient to delivery disruptions.

Top Irish cities most at risk of delivery delays, per capita (10,000)

| City/Town | Delivery Vacancies (Total) | Delivery Job Gap (per 10,000) | Delivery Gap % change since 2024 |

| Drogheda | 52 | 12.7 | 460.4% |

| Cork | 98 | 5.1 | 249.8% |

| Dundalk | 18 | 4.6 | 65.8% |

| Waterford | 23 | 3.8 | -4.2% |

| Dublin | 350 | 3.4 | 15.8% |

| Limerick | 30 | 2.9 | -6.2% |

How delivery shortages have shifted since 2024

Delivery pressures across Ireland have changed significantly in the past year, with several areas seeing substantial increases in both vacancy numbers and per-capita delivery gaps.

Drogheda has seen the most dramatic rise, with delivery role vacancies increasing by 420% year-on-year and the delivery job gap climbing 460%, making it the area experiencing the fastest-growing strain on courier capacity.

Cork follows, recording an 85% uplift in overall vacancies and a nearly 250% increase in its delivery gap per capita compared to 2024 figures, suggesting demand is rapidly outpacing available labour.

Dundalk and Dublin have also recorded increases, though at lower levels. Dublin, Ireland’s busiest ecommerce hub, saw its overall vacancies double year-on-year.

Where delivery pressures are rising fastest in Ireland

| Town / City | Delivery Job Gap (per 10,000) | Delivery Gap (% change since 2024) | Vacancies in total (% change since 2024) |

| Drogheda | 12.7 | 460.4% | 420.0% |

| Cork | 5.1 | 249.8% | 84.9% |

| Dundalk | 4.6 | 65.8% | 50.0% |

| Dublin | 3.4 | 15.8% | 100.0% |

Christmas driver vacancies

There were 50 open ‘Christmas Driver’ roles available in Ireland, at the time of analysis. As the busy holiday season approaches, the present shortage could quickly grow to become a challenge for Irish businesses looking to meet tight delivery deadlines, especially after the sudden closure of Fastway Couriers.

Against this backdrop, the shortage of seasonal roles, if left unaddressed, risks intensifying pressure across Ireland’s delivery network as demand accelerates in the final month of the year.

Top tips for businesses

Chris Gorman, Head of Commercial Transformation at Esendex, said:

“We’ve already seen a major surge in consumer spending around key retail events like Black Friday, and as we head deeper into the holiday season, demand from online shopping will intensify even further. While this period represents a huge commercial opportunity, it also exposes retailers to a range of operational pressures, particularly as a result from fragile delivery networks.

“The latest findings from our ‘Delivery Delays Report’ reveal that delivery pressures are intensifying across Ireland, with over 600 vacant delivery roles nationally – equivalent to 11.8 vacancies per 100,000 residents. Key areas like Drogheda and Cork are feeling the impact the most, but larger cities like Dublin are also seeing rising strain, with per-capita gaps widening by nearly 16% year-on-year.

“Concerningly, this year’s figures show a 47% increase in delivery vacancies across Ireland compared to 2024, signalling that labour gaps within the workforce have widened considerably over the last twelve months.

“This situation has been further exacerbated by the recent collapse of one of Ireland’s major parcel operators, which left tens of thousands of parcels in limbo just as we entered the busiest ecommerce period of the year.

“To meet heightened consumer expectations, companies should prioritise customer engagement and satisfaction strategies. Solutions such as SMS and WhatsApp for Business can help mitigate any potential delivery setbacks as fast and clear updates sent directly to customers can ensure a successful and seamless peak season experience.

“Allowing businesses to connect with customers instantly about delivery status, any delays, and estimated arrival times, supports real-time communication that better manages expectations and customer satisfaction. By keeping customers informed, businesses are also reducing pressure on customer service channels while prioritising the customer experience during busy shopping periods.”

Find out more about SMS solutions for the retail industry here.

Methodology

Building on last year’s ‘Delivery Delays Report’, Esendex collected and analysed job vacancy data from Indeed across 40 UK regions, and 15 locations in Ireland and Australia. Using keywords for common delivery roles and seasonal positions, Esendex examined the number of vacancies listed on Indeed and then calculated the vacancy rate relative to total population data to estimate the per capita demand for delivery roles.

This enabled Esendex to identify the regions where customers may experience greater risks of delays through the peak shopping season, as well as assess year-on-year trends in vacancies.

All data is correct as of November 2025.